Bitcoin Fixes Everything Because Broken Money Ruins Everything

Spend, spend, spend!

“Bitcoin fixes this.” — it’s a meme you’ll see if you spend any time talking with Bitcoiners. Dog pooped in the living room? Bitcoin fixes this. Late for work? Bitcoin fixes that too. Ok, maybe it doesn’t fix everything, although I could make a straight faced argument how Bitcoin could possibly fix those. In truth, an absolutely monstrous number of problems are created by broken money and it’s completely not obvious that it’s because of the broken money. In this article, I want to explore this a bit and think though why inflation, the primary reason our money is broken, is the cause of so many woes and why Bitcoin fixes this.

What is inflation?

When I’m talking about inflation, I specifically mean the increase in the money supply. If the number of dollars goes up but the number of goods and services stays the same, then prices go up. How this all happens exactly is quite technical, varies from country to country, and other people have written about it better than me. Most people I talk to about inflation are so immediately put off by how abstract it all seems with the numbers and jargon. I want to avoid all that and focus on what almost everyone agrees on:

Central banks create money

Prices go up

Wages don’t go up as fast as prices

These aren’t in dispute. Indeed, the stated goal of the Federal Reserve (aka FED), the central bank of the united states, is to inflate the money supply by 2% every year to encourage spending. The dispute comes from whether or not inflation is a good thing. To briefly summarize the argument in favor of inflation: you have to encourage people to spend or they’ll hoard their money, businesses will collapse because no one is spending, people will lose their jobs because businesses are collapsing, and so on forever until we all die poor and lonely.

Personally, I think it takes a great deal of education to believe an argument so obviously garbage. People won’t hoard their money — we all need to eat, and we all want nice things. Economists are a little too incentivized to come up with a theory for why the state should be allowed to get something for nothing. Regardless of any technical faults with the argument for inflation, it’s completely immoral because it requires violence to enforce. I’ll leave it to others to explain in detail why the argument for inflation is bunk. In this article, I just want to focus on how the stated goal of inflation ruins everything.

The more you stare at this, the more you’re convinced they’re just humble civil servants!

Inflation Ruins Products and Services

Let’s say you sell hamburgers. If you want to stay in business, you have to sell your hamburgers for more than they cost to make. Let’s say you can make high-quality, deluxe hamburgers for $4 and sell them for $5.

Now comes along inflation and beef prices have gone way up, the gourmet buns you use are more expensive, and so on. Your costs are driven up to $5. What are you going to do about the sale price of your hamburgers?

Keep price the same; go out of business

Raises the price

Lower quality

Option #1 is clearly out of the picture. You either have to raise the price or lower the quality or some combination.

Raising prices could have a very negative effect. There’s competition who’s willing to sacrifice quality to keep prices as low as possible. Maybe they can leverage their brand recognition, better marketing research, adding sugar and fat, and other psychological tricks. There’s a big difference between having 0 hamburgers and having 1 hamburger, but there’s not much of a difference between having 1 hamburger and having 1 expensive, gourmet hamburger. Lower prices will win for most people. Your choice is to compete by slashing quality or go after the much smaller, more affluent market willing to pay a premium for a top-notch hamburger.

Let’s say you want to maximize your profits so you decide to reduce quality. You don’t want to tell your customers quality has gone down. You try and hide it. You buy cheaper beef which isn’t as nutritious and takes more work to make it taste as good. You have to cover up the flavor with salt, flavored oils, and other spices. You have to switch to a mass produced bread which is optimized for shelf life instead of flavor so you can save money on spoilage. You switch from free-range eggs with beautiful, nutritious, yellow yolks to bulk-produced, tasteless eggs. And so on, and so on, for every ingredient. Each replacement brings your costs down but the product suffers a death of a thousand tiny cuts. Eventually you have a product which doesn’t taste as good, has more preservatives, and isn’t as nutritious.

What’s worse is that everyone is doing this! Even if you kept your ingredients the same, the people making those products are facing the same dilemma to cut quality or increase prices. Even if you kept trying to make your gourmet hamburger, all of your input ingredients are slowly getting worse or more expensive.

No one notices because everything gets worse at an insidiously slow pace. Unless you’re over 100 years old, slowly increasing prices and decreasing quality is all you’ve ever known. With the increases we’ve had in production efficiency due to technology, specialization, and global trade, we should be living in a utopia of increasing quality and decreasing prices. Instead we get the opposite! Quality goes down and prices go up. All so the people in charge, that you don’t vote for, can print money and give it to their friends, all for your own good.

Inflation Ruins Finance

Your money is constantly losing value — it’s on fire. How can you save for your future, for your retirement, for your children? The only choice most people have is to “invest” by gambling in the stock market. It’s not called gambling, of course. It’s given a more reasonable, official name like “401k retirement account” or “Roth IRA”, but it’s all the same: you give your money to someone, hope they make 1,000,000 correct decisions about what stocks to buy and sell and when to time everything, and pray they can just beat inflation.

Lots of people have retirement accounts. That means lots of money is going into the financial sector. This creates a huge incentive for all the top talent to work in finance and drains them away from other industries. Instead of starting a business building something, creating innovations in the medical field, innovating some new technology that’ll make all of our lives better, they solve another problem, one created by government: it’s so damned hard to persist the value of your labor through time. Huge, powerful financial companies are created and fed by all of the money from retirement accounts pouring into the system. These companies can then use their power and influence to corrupt the government. There’s a revolving door between banks, the SEC, and the FED. They’re all in bed together and as a cold-eyed capitalist, I don’t blame them for making the rational decision.

And all this trading is to beat inflation, remember? The Federal Reserve targets 2% inflation per year but their official numbers for 2022 are closer to 8%, and that’s with all of their bullshit hedonic adjustments. Real inflation is closer to 17% if you go by the 1980s method of calculating.

Turns out you can’t lock down the economy for 2 years and print out a bunch of free money for people without some consequences. Since 2012, prices have been inflating at 10% a year. Making a 10% return with stock trading is an extremely good year, and even if you can manage it, you’re just breaking even.

Inflation Ruins People’s Morals

The stated goal of inflation is to discourage saving and encourage spending and that’s exactly what it does. If you put your money under a mattress or into a savings account, the value is evaporating every year. Might as well spend it! This way of thinking leads to ruin.

The ability to forgo present consumption for increased future consumption is core to what makes humans different from other animals. The famous Marshmallow Experiment showed that children who could control themselves and save for the future did better on average in future test scores. This is essentially what the Gom Jabbar tests for.

Paul Atreides — The Original 💎🙌

This scene from the sci-fi classic Dune. Paul is being tested if he can endure his hand being in a box which causes him pain. The pain grows over time and he dies if he takes his hand out.

"It kills only animals, Let us say I suggest you may be human. Steady! I warn you not to try jerking away. I am old, but my hand can drive this needle into your neck before you can escape me."

―Reverend Mother Gaius Mohiam while testing Paul Atreides with a Gom Jabbar

With inflation, savers are punished and spenders are rewarded. This creates a society obsessed with consumption. People ruin their futures by over consumption and going into debt. This harms society because of having morally strong people who’ve been taught from a young age that saving pays off, we have a bunch of people living paycheck to paycheck with no savings for an emergency. And what are they buying with all of this consumption? Increasingly cheap and inferior products!

When your mind switches to a Bitcoin standard, you’ll find yourself constantly talking yourself out of buying stuff because you know you can just buy Bitcoin and it’ll be worth more later without any work. Why shouldn’t it be this easy? You worked hard for your money; why shouldn’t it be worth more as society gets better at making stuff? You start to think in terms of how to work harder and smarter and save more. This lets you take risks as you get older and maybe start a business, invest in your community, donate to charity, etc.

Inflation Ruins Government

Check this out. It’s a map of all the countries the united states has “intervened” in.

How do you suppose the government paid for all this? Taxes? No, no. If you had to raise people’s taxes to pay for your endless wars, the great unwashed masses might get suspicious, or worse, angry. With inflation, you just fiddle with some numbers in a database and poof! you have more money and no one is the wiser. Now, you’re free to give this money away for “free” to encourage everyone vote for you. When the economy invariably suffers, you can just blame someone else!

Even if you believe the government should have the ability to print money because you buy into the mainstream argument that they’re saving us from ourselves, you have to admit that having access to the money printer is a huge temptation and there’s very little public understanding or oversight into how it works. We just sort of trust whoever is in charge of the central bank is really smart and is totally trying to keep the economy in tip-top shape.

How Bitcoin Fixes Everything

There will only ever be 21 million bitcoin. As we get better at making stuff, there’s more stuff to buy, and there will still only be 21 million bitcoin chasing an increasing number of goods and services. This means the prices for things in bitcoin will go down as the purchasing power of your bitcoin goes up. Importantly, you can’t get rid of bitcoin — it’s an idea. Governments can ban it, sure, and they could ban the internet too, I guess. If they ban bitcoin, all of the bitcoin businesses, talent, innovation, and tax revenue just go elsewhere. Meanwhile, regardless of the ban, people will continue to sell their increasingly worthless fiat for real money: bitcoin.

If your value is in bitcoin, the government can’t rob you through inflation. They could beat you with a rubber hose, I guess, and get you to reveal the private key, but, on the whole, the cost of seizing your property goes up. As the cost of stealing from you goes up, governments have to rely on you giving money voluntarily, and they have to treat you more like a customer instead of a tax cow. As governments have less ability to pay for stuff with inflation, they have to focus on things people actually want. All the wars, waste, corruption, and boondoggles slowly fade away.

With bitcoin, you don’t need to gamble in the stock market to save money. You don’t have to incentivize stock traders and giant financial companies. You can just buy bitcoin. Done. All of those clever, hard working stock traders can now go work somewhere else and solve real problems instead of ones created by government. You don’t have to hope the FED doesn’t tank the economy and destroy your life’s savings in your retirement account right before you retire.

Fix the Money, Fix the World

Money is information. If I do work for you and provide value, you give me money as a way of recording how much value I provided. Money is a value of how much you’ve helped your fellow man and how much value you’ve added to society. If people are giving you money voluntarily and you’re not lying or using violence, then the amount of money you get is a proxy for how much value you’ve given society. If government distorts this mechanism, this information, by artificially assigning itself more value, it throws the system into chaos because everyone’s value, information, money is on fire. The world is worse and in subtle, insidious ways that are hard to put a finger on.

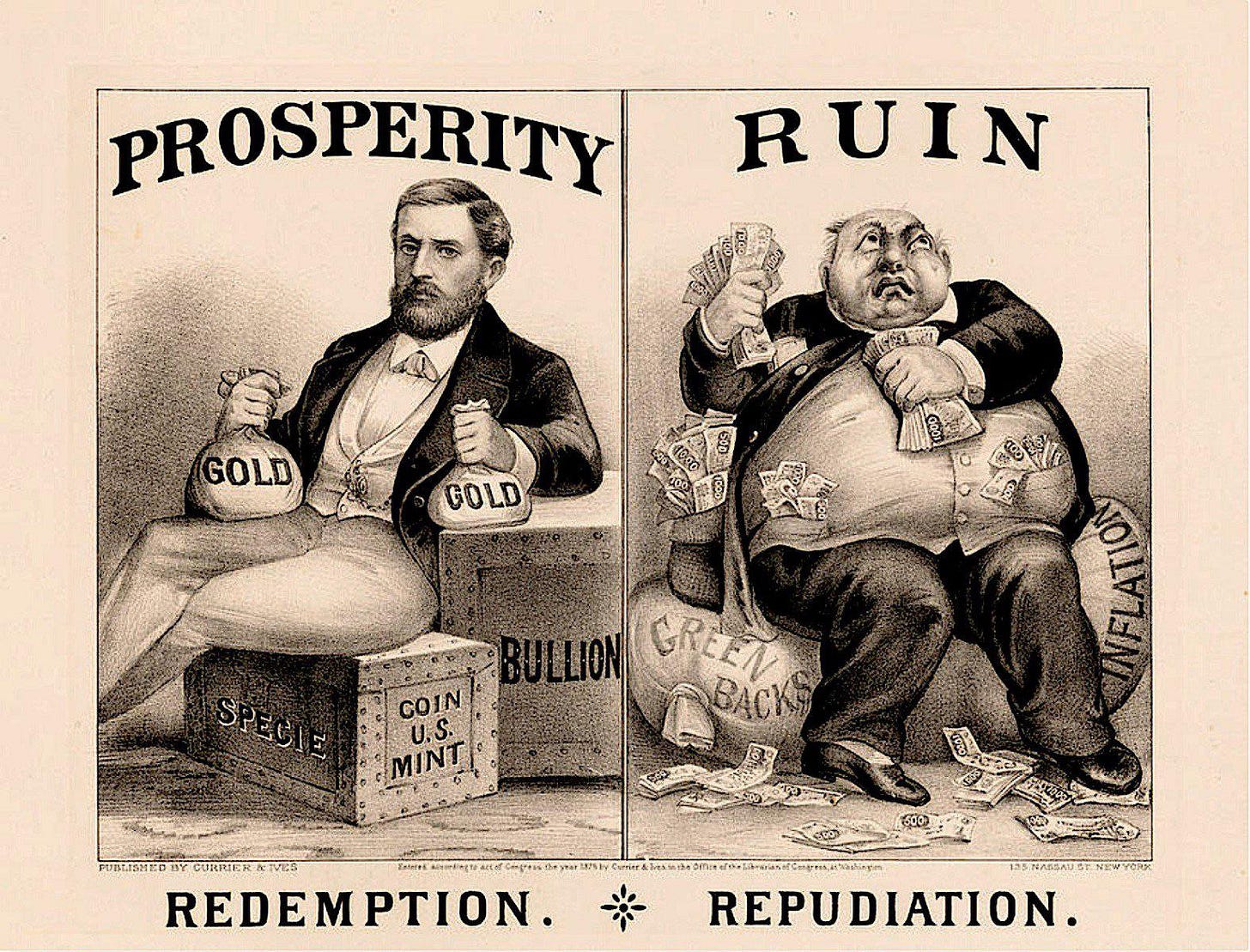

People have been sounding the alarm about the dangers of inflation since forever. Maybe the warnings fell on deaf ears because people were too busy, too distracted, and the damage is spread out so thinly over time. Maybe it didn’t matter because the government forcibly confiscated everyone’s gold.

Bitcoin doesn’t suffer the same problems as gold. Gold is easy to confiscate because it’s heavy and hard to move around. You have to pay people to custody it and you have to empower intermediaries to verify it exists and coordinate transactions. Bitcoin doesn’t have these problems. It’s weightless and can be sent to anyone anywhere with no one’s permission in seconds or minutes. Bitcoin’s much harder to confiscate because it can be reduced down to just 12 seed words you can just memorize — it’s like knowing an honest-to-god magic spell that gives access to money. If you’re worried about the $5 wrench attack, Bitcoin is programmable so you can use a collaborative custody multi-wallet such as Unchained.

Now is the time to vote with your value. If you don’t like inflation, if you believe in the separation of money and state, if you don’t like being robbed without getting to vote on it, simply trade your increasingly worthless fiat for Bitcoin. Start today. Buy a little every week. Join the future.

Nice job in taking truths and creating a digestible narrative.